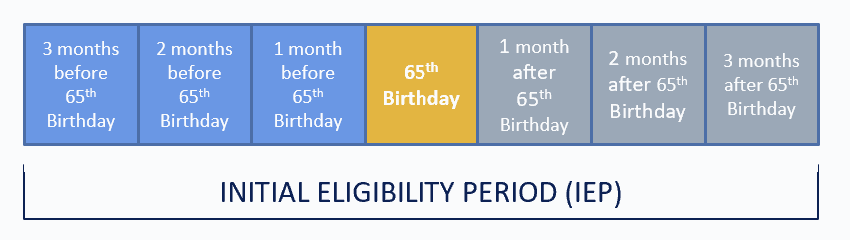

Medicare.gov defines Medicare as health insurance for people 65 or older and certain people with specific disabilities. You are first eligible to sign up for Medicare 3 months before turning 65. The Initial Enrollment Period for Medicare begins 3 months before your 65th birthday and continues 3 months after your birthday. Including your birth month, the total length of time the IEP is open is 7 months.

Original Medicare

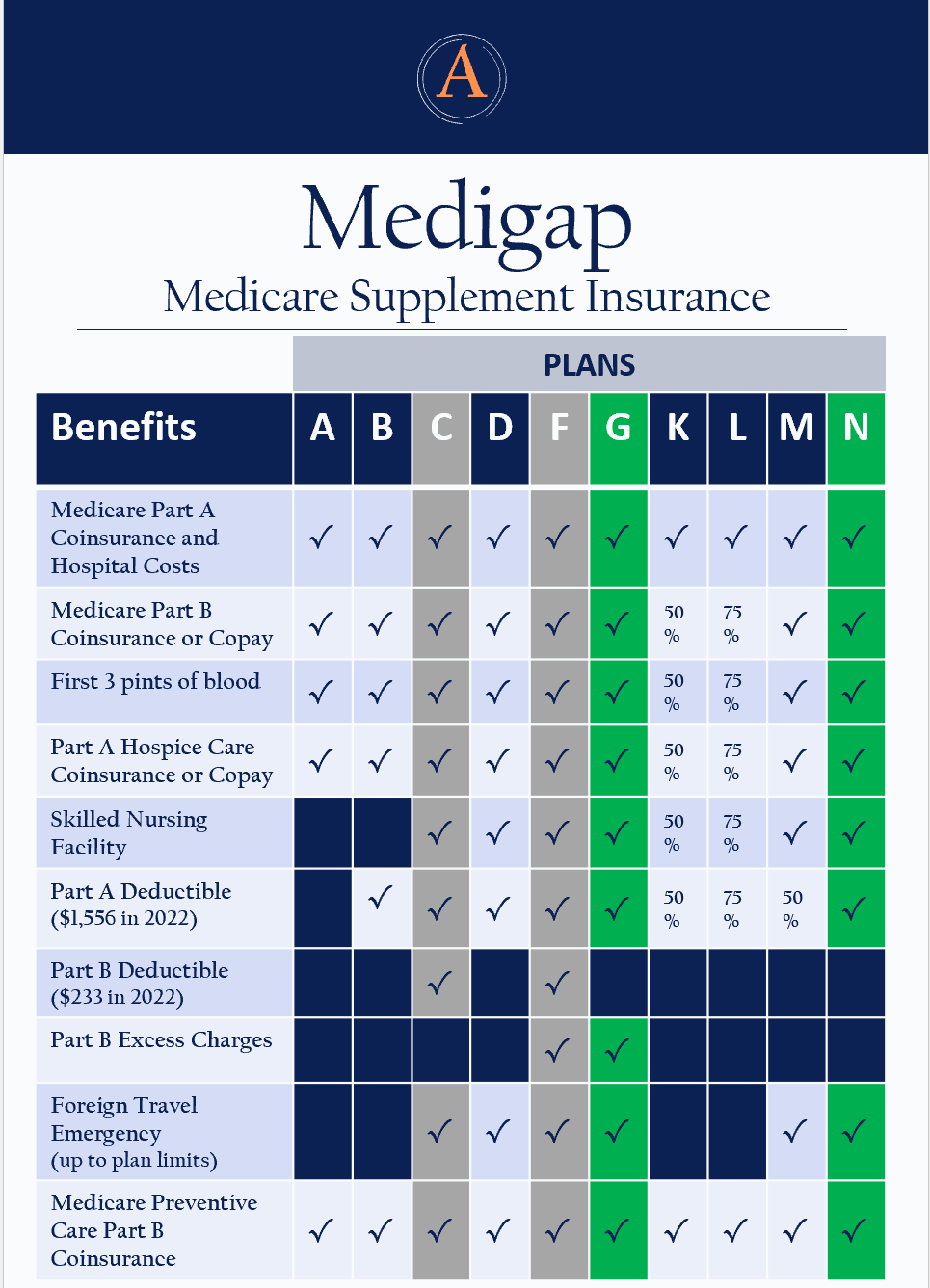

Medigap is also known as Medicare Supplemental Insurance. This supplemental insurance plan applies to Original Medicare only. It is an additional policy that beneficiaries can enroll in to cover the gaps left by Medicare. Ten Medigap policies offer various levels of coverage (See table for reference). Each plan letter offers a standardized set of coverages regardless of the carrier or geographic location. While coverages are standardized, plan rates may vary from carrier to carrier and location to location based on the carrier experience with paying claims.

Original Medicare plus Medigap gets you the Cadillac of Medicare coverages.

Medigap premiums are subject to increase.

Original Medicare and Medigap plans do not cover the following:

Original Medicare and Medigap plans do not cover the following:

Medicare Supplements, also known as Medigap policies, are sold by private insurance companies to help you cover the out-of-pocket costs left behind by Medicare. When you have a Medigap policy, Medicare pays up to its limit on your medical expenses. Then, your Medicare Supplement plan with then kick in up to its limit. That limit usually is able to pay off the remainder. However, that will depend on which policy you select.